Photo credit: Nathan Dumlao, Unsplash

Shedding light on the personal loan experience

Supporting a team of researchers and designers at a mid-sized FinTech organization in learning about and generating concepts to address user needs, expectations, and concerns related to unsecured personal loans and the platforms through which they are requested.

Lead Researcher & Project Manager

Delve, 2020

Internal collaborators

Insights & Strategy peers, Industrial Design, Service Design, Visual Communications, Sales

Client collaborators

Senior Managers of Customer Insights and Design, UX Researchers, Sr.

Impact

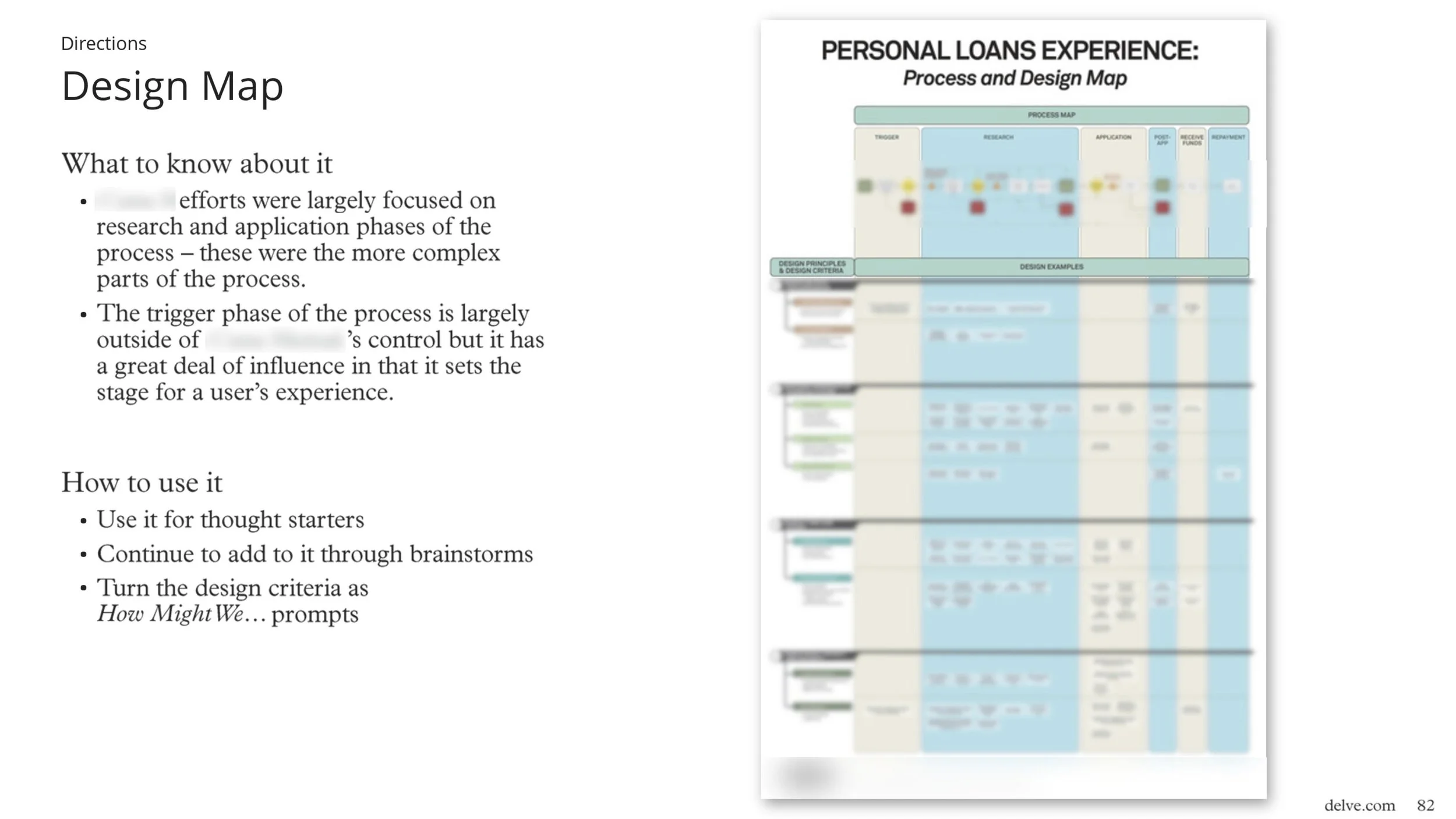

Frameworks, metaphors, and detailed design guidelines were used to inform the client's continued design and development work to address the unique needs of consumers in the personal loan application and borrowing process. A process map of the user experience provided our client the foundational insights for continued research and idea generation.

Note: This effort was conducted in a “learn/do” manner as the client team was actively working to up-skill and establish a design research practice at their organization. This entailed bringing the client team closely along in the development of research protocols and tools, analysis processes, and dedicating extra time to teaching about methods and best practices.

Tools & techniques applied

In-depth interviews with internal stakeholders and subject matter experts

Competitive analysis

Research operations including recruitment (Respondent), scheduling, agreements & forms, guide & stimuli development

Experience & process mapping

Jobs-to-be-Done theory

Ideation & storyboarding

Concept testing

Miro

Facilitation of co-analysis sessions, ideation workshops, and decision-making meetings

Project management

Key project activities

Designed and conducted discovery research (n=16 in-depth interviews) and concept testing (n=15 usability tests) to understand people’s experiences attaining a personal loan and explore concepts to address unmet needs and pain points. Managed all participant recruitment, scheduling, and incentives via the recruitment platform, Respondent.

Visuals: Multiple sources - primary and secondary - for discovery research were leveraged.

Completed competitive desk research to understand the landscape of lenders, experiences, and information available to borrowers.

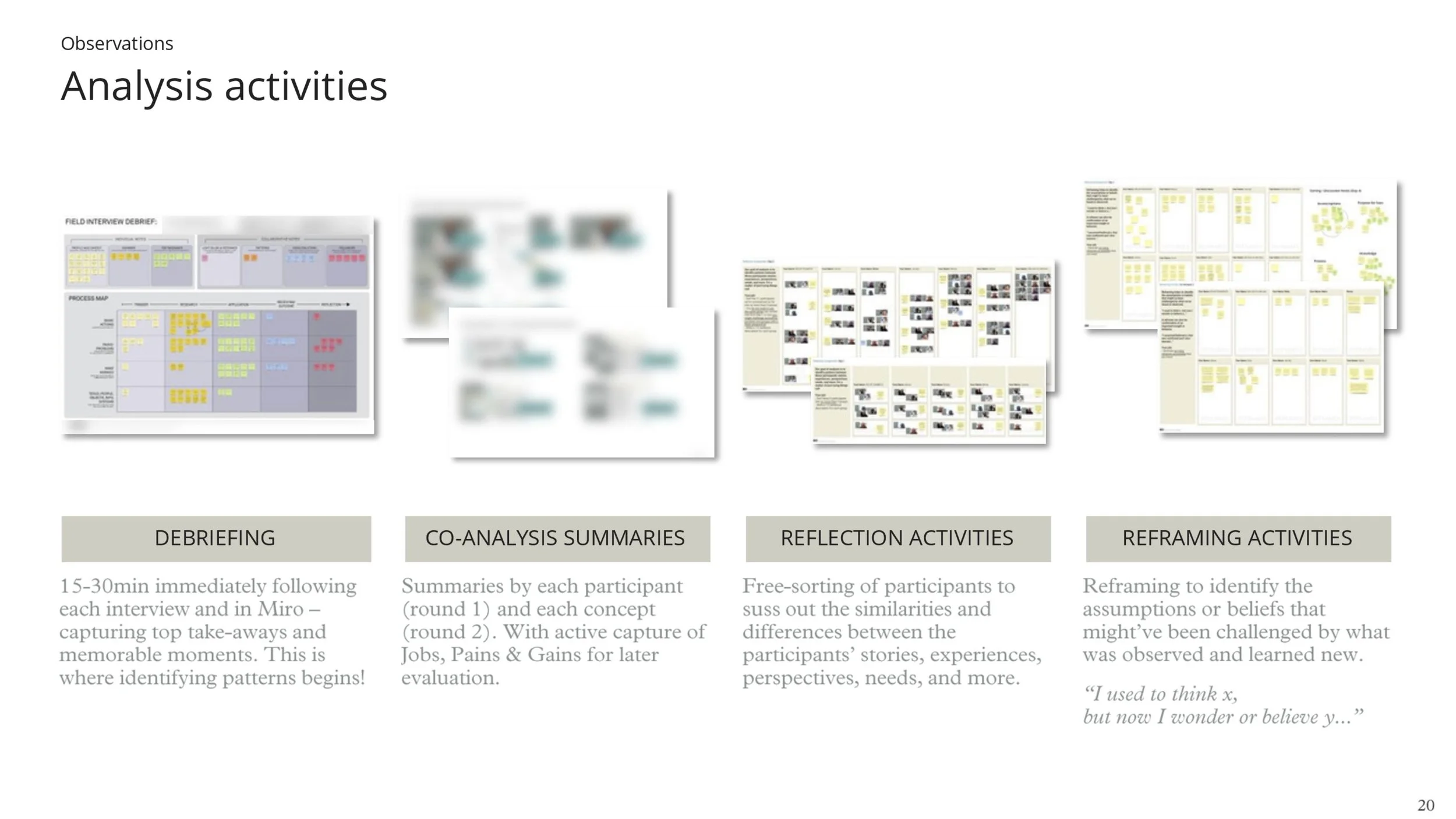

Led structured debriefing sessions following every participant interview to capture top take-aways and begin identifying patterns early.

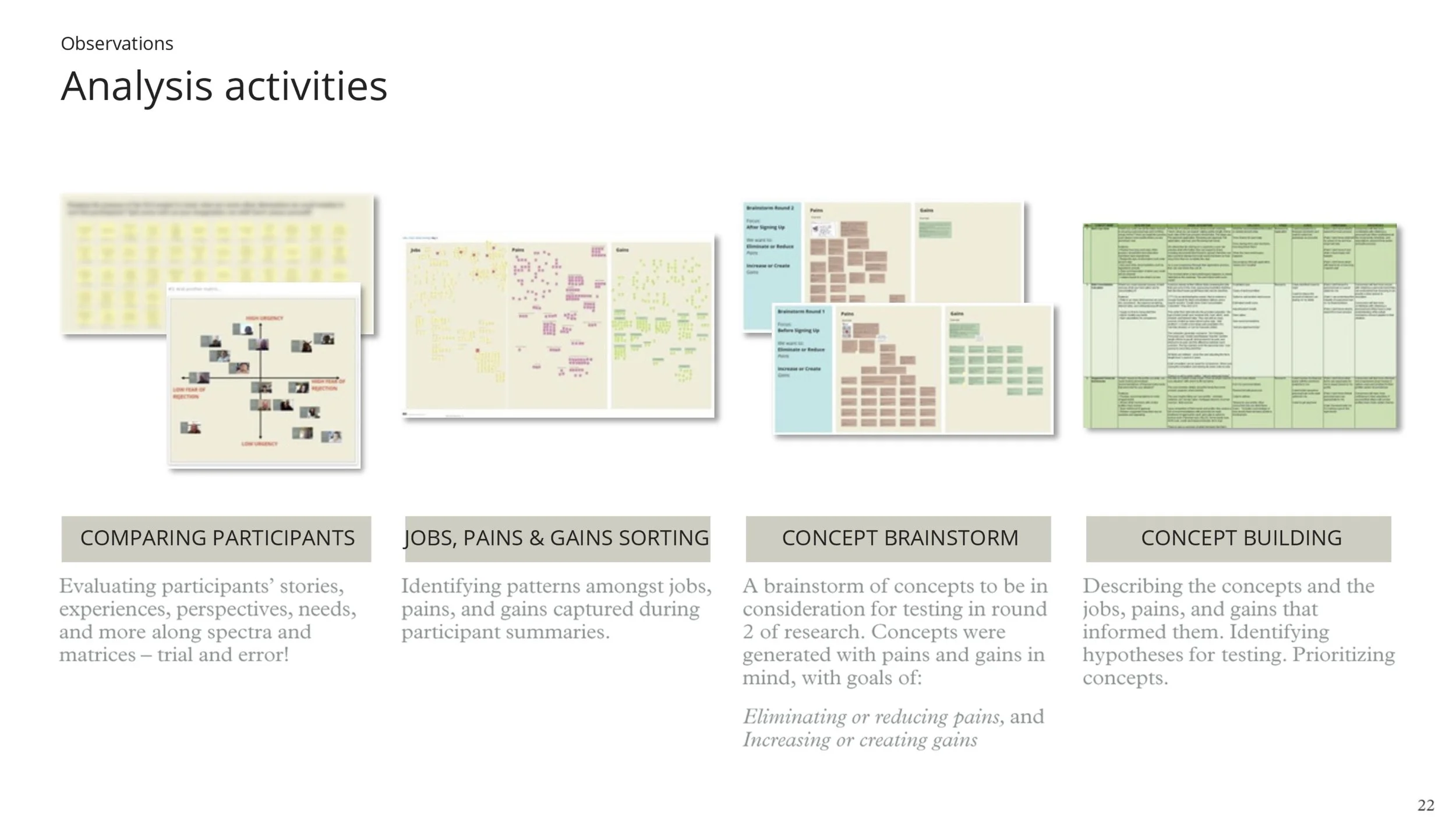

Developed and presented detailed participant summaries and facilitated Co-Analysis work sessions with active capture of jobs, pains, and gains, reflection and reframing exercises, affinity mapping, and idea generation.

Facilitated client down-selection of concepts to test, developed rough storyboards and concept descriptions, and worked with the design team to refine visualizations.

Visuals: Analysis activities were thorough and conducted collaboratively with all project stakeholders.

Created a detailed final delivery report with all project findings and recommendations, including concept refinements.

Managed the active program, including successfully negotiating a budget increase to account for client delays to the project timeline.